2021 w4 calculator

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Lets call this the refund based adjust amount.

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

250 minus 200 50.

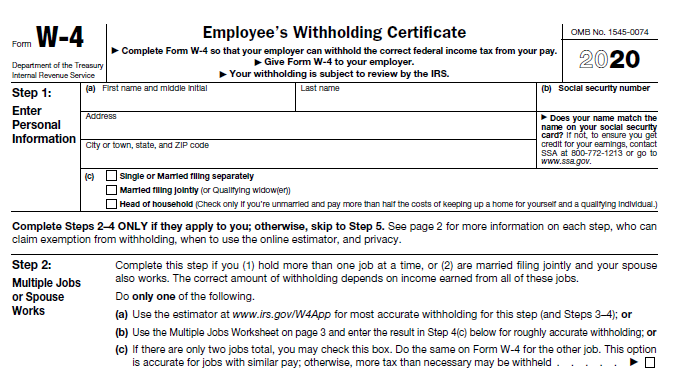

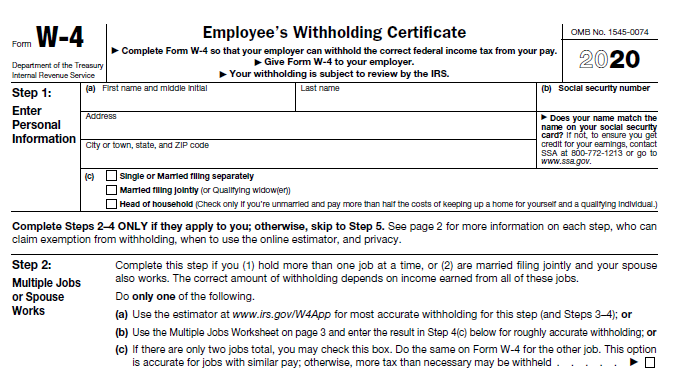

. Give Form W-4 to your employer. TurboTax offers a free suite of tax calculators and tools to help save you money all year long. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Then look at your last paychecks tax withholding amount eg. Thats where our paycheck calculator comes in.

The amount of income tax your employer withholds from your regular pay depends on two things. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Free salary hourly and more paycheck calculators.

See your tax refund estimate. For Job 1 start with the job for which you want to complete a W-4 form. Figure out which withholdings work best.

Or keep the same amount. Use your estimate to change your tax withholding amount on Form W-4. Enter your new tax withholding.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Well calculate the difference on what you owe and what youve paid. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

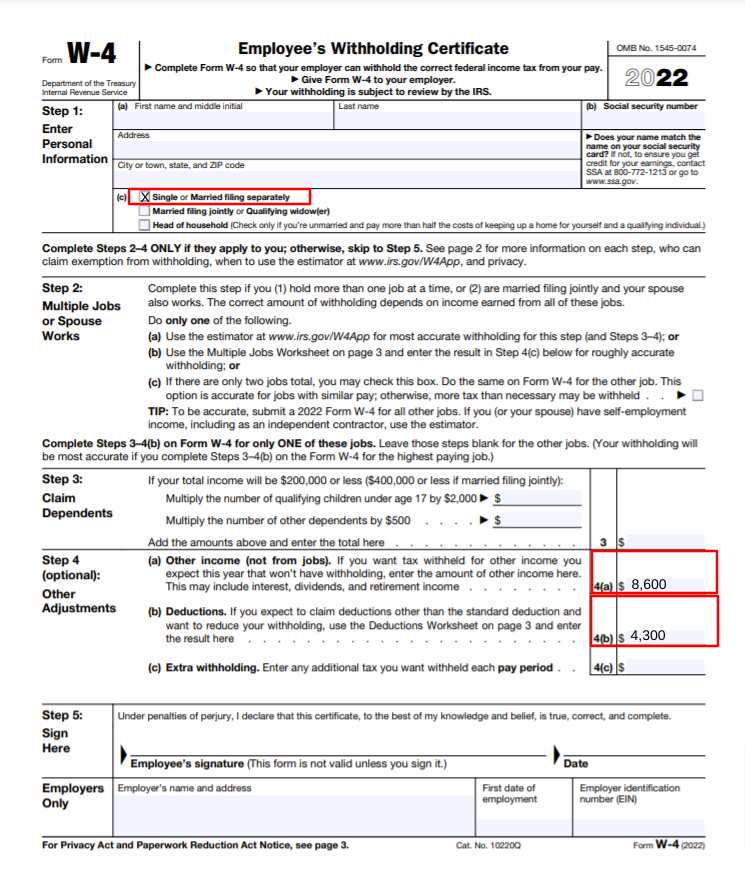

The W-4 Pro Calculator is the most advanced and accurate planning tool to optimize your W-4s as it is based on your estimated or actual 2021 or estimated 2022 2023 tax return. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Enter thisamount here and in Step 4c of Form W-4 for the highest paying job along with any other.

Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022. To change your tax withholding amount. 250 and subtract the refund adjust amount from that.

Use our W-4 calculator. Be sure that your employee has given you a completed. Your withholding is subject to review by the IRS.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. The information you give your employer on Form. The amount you earn.

The tax calculator provides a full step by step breakdown and analysis of each. This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed Expense. For example if an employee earns 1500.

The W-4 Pro Calculator is the most advanced and accurate planning tool to optimize your W-4s as it is based on your estimated or actual 2021 or estimated 2022 2023 tax. IRS tax forms. How to calculate annual income.

Up to 10 cash back Contributions this year. Divide the annual amount on line 1 or line 2c by the number of pay periods on line 3. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. If your employer does not withhold taxes then you. Then get Your Personal Refund Anticipation Date before you Prepare and e-File your 2021 IRS.

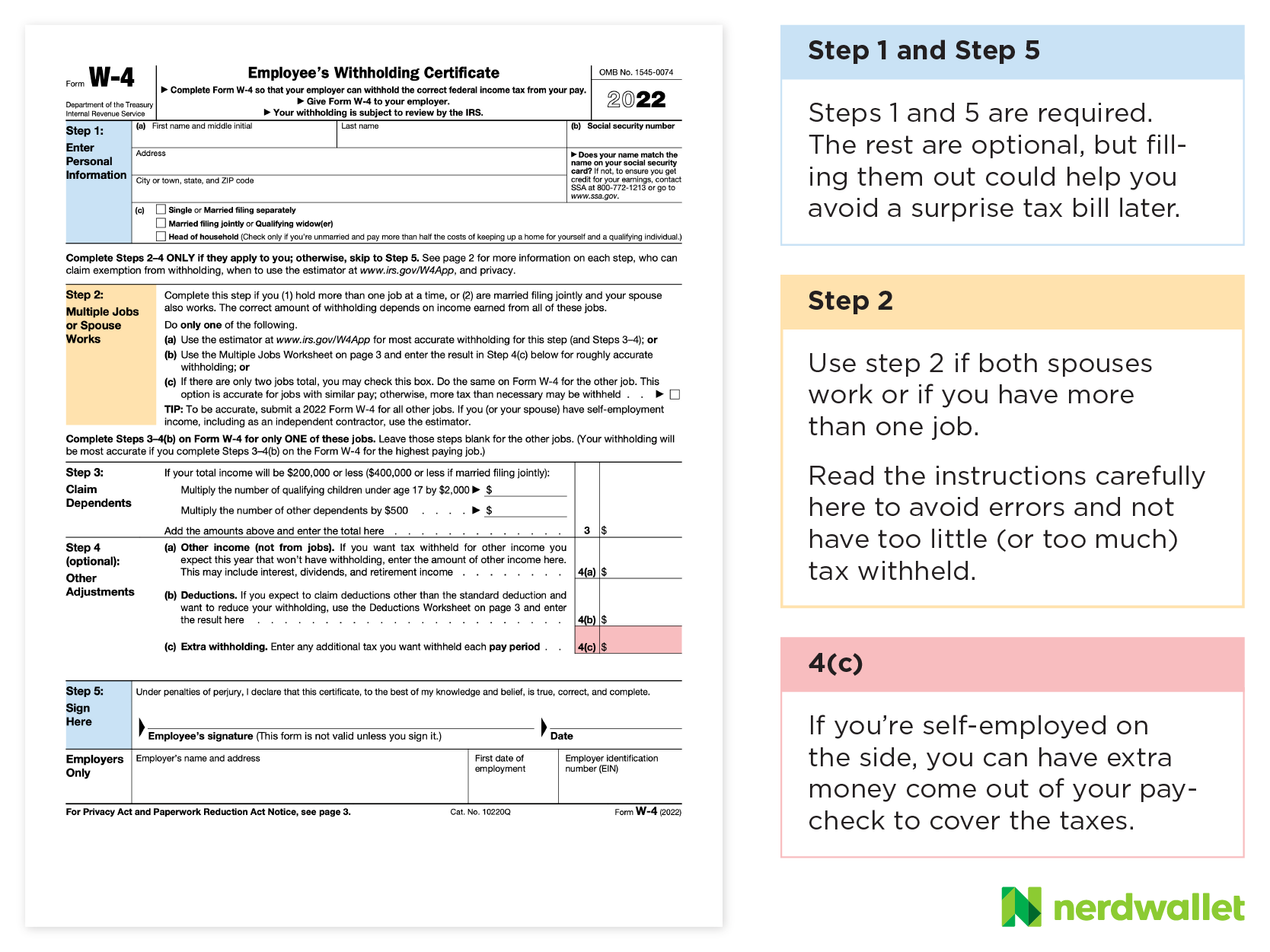

W 4 Form What It Is How To Fill It Out Nerdwallet

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

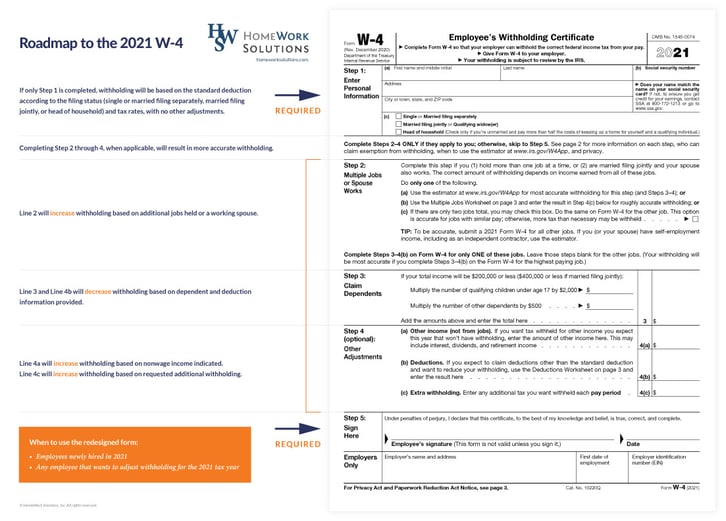

W 4 Form Basics Changes How To Fill One Out

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

What Is A W 4 Form How It Works Helping Your Employees Complete It

New W4 For 2021 What You Need To Know To Get It Done Right

Free W 4 Calculator Tax Withholding Info For Hr Professionals Goco Io

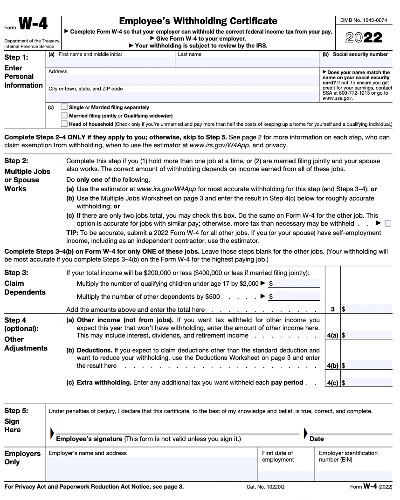

W4 Form 2021

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Paycheck Tax Withholding Calculator For W 4 Tax Planning

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Irs Improves Online Tax Withholding Calculator

Federal And State W 4 Rules

W4 Tax Form 2022 With Calculations W 4 Tax Form How To Fill Out W4 Tax Form 2022 Youtube

How To Fill Out A W4 2022 W4 Guide Gusto

2022 New Federal W 4 Form No Allowances Plus Computational Bridge

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert